Real Estate Blog & Advice

Homeownership Is Full of Financial Benefits

A Fannie Mae survey recently revealed some of the most highly-rated benefits of homeownership, which continue to be key drivers in today’s power-packed housing market. Here are the top four financial benefits of owning a home according to consumer respondents: 88% – a...

Latest Jobs Report: What Does It Mean for You & the Housing Market?

Last Friday, the Bureau of Labor Statistics released a very encouraging jobs report. The economy gained 916,000 jobs in March – well above expert projections of 650,000 to 675,000. The unemployment rate fell again and is now at 6%. What does this mean for you? Our...

Don’t Sell on Your Own Just Because It’s a Sellers’ Market

In a sellers’ market, some homeowners might be tempted to try to sell their house on their own (known as For Sale By Owner, or FSBO) instead of working with a trusted real estate professional. When the inventory of homes for sale is as low as it is today, buyers are...

Your Tax Refund and Stimulus Savings May Help You Achieve Homeownership This Year

If you’re planning to buy a home this year, saving for a down payment is one of the most important steps in the process. One of the best ways to jumpstart your savings is by starting with the help of your tax refund. Using data from the Internal Revenue Service (IRS),...

Buyer Competition Is Good News for Sellers [INFOGRAPHIC]

Some Highlights With so many buyers looking for homes to purchase and so few houses available today, there’s a substantial increase in bidding wars, and homes are selling fast. According to the latest Realtors Confidence Index Survey from the National Association of...

There’s No Reason To Panic Over Today’s Lending Standards

Today, some are afraid the real estate market is starting to look a lot like it did in 2006, just prior to the housing crash. One of the factors they’re pointing to is the availability of mortgage money. Recent articles about the availability of low down payment loans...

Is Homeownership Still Considered Part of the American Dream?

Since the birth of our nation, homeownership has always been considered a major piece of the American Dream. As Frederick Peters reports in Forbes: “The idea of a place of one’s own drives the American story. We became a nation out of a desire to slip the bonds of...

How a Change in Mortgage Rate Impacts Your Homebuying Budget

Mortgage rates are on the rise this year, but they’re still incredibly low compared to the historic average. However, anytime there’s a change in the mortgage rate, it affects what you can afford to borrow when you’re buying a home. As Sam Khater, Chief Economist at...

What It Means To Be in a Sellers’ Market

If you’ve given even a casual thought to selling your house in the near future, this is the time to really think seriously about making a move. Here’s why this season is the ultimate sellers’ market and the optimal time to make sure your house is available for buyers...

2021 Real Estate Myth Buster [INFOGRAPHIC]

Some Highlights There are a lot of misconceptions about buying or selling a home today, making it challenging to know exactly how to navigate the current real estate landscape. Here’s a little clarity when it comes to 5 common myths about the 2021 housing market....

Buyer & Seller Perks in Today’s Housing Market

Right now, the housing market is full of outstanding opportunities for both buyers and sellers. Whether you’re thinking of buying your first home, moving up to a bigger one, or selling so you can downsize this spring, there are perks today that are powering big moves...

Why You Should Think About Listing Prices Like an Auction’s Reserve Price

For generations, the homebuying process never really changed. The seller would try to estimate the market value of the home and tack on a little extra to give themselves some negotiating room. That figure would become the listing price of the house. Buyers would then...

Should We Fear the Surge in Cash-Out Refinances?

Freddie Mac recently released their Quarterly Refinance Statistics report which covers refinances through 2020. The report explains that the dollar amount of cash-out refinances was greater in 2020 than in recent years. A cash-out refinance, as defined by Investopia,...

What Credit Score Do You Need for a Mortgage?

According to data from the most recent Origination Insight Report by Ellie Mae, the average FICO® score on closed loans reached 753 in February. As lending standards have tightened recently, many are concerned over whether or not their credit score is strong enough to...

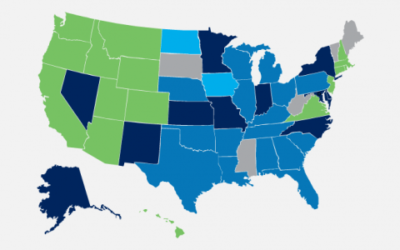

Americans See Major Home Equity Gains [INFOGRAPHIC]

Some Highlights Today’s home price appreciation is driving equity higher throughout the country. If your needs are changing and you’re ready for a new home, your equity may be a great asset to power your next move. Now is a great time to put your equity toward a down...

How Upset Should You Be about 3% Mortgage Rates?

Last Thursday, Freddie Mac announced that their 30-year fixed mortgage rate was over 3% (3.02%) for the first time since last July. That news dominated real estate headlines that day and the next. Articles talked about the “negative impact” it may have on the housing...

6 Simple Graphs Proving This Is Nothing Like Last Time

Last March, many involved in the residential housing industry feared the market would be crushed under the pressure of a once-in-a-lifetime pandemic. Instead, real estate had one of its best years ever. Home sales and prices were both up substantially over the year...

Will the Housing Market Bloom This Spring?

Spring is almost here, and many are wondering what it will bring for the housing market. Even though the pandemic continues on, it’s certain to be very different from the spring we experienced at this time last year. Here’s what a few industry experts have to say...

How to Be a Competitive Buyer in Today’s Housing Market [INFOGRAPHIC]

Some Highlights With so few houses for sale today, it’s important to be prepared when you’re ready to buy a home. Meeting with your lender early, knowing your must-haves and nice-to-haves, preparing for a bidding war, and keeping your emotions in check are all ways to...

How to Make a Winning Offer on a Home

Today’s homebuyers are faced with a strong sellers’ market, which means there are a lot of active buyers competing for a relatively low number of available homes. As a result, it’s essential to understand how to make a confident and competitive offer on your dream...

What Is the #1 Financial Benefit of Homeownership?

There are many financial and non-financial benefits of homeownership, and the greatest financial one is wealth creation. Homeownership has always been the first rung on the ladder that leads to forming household wealth. As Freddie Mac explains: “Homeownership has...